Hotels & Motels

Small Business Owner Resource

SBA 7(a) lending intel on SBAmatch is designed to help Small Business Owners avoid the mistake of applying with the wrong lender. Every lender is different, and matching to the right one with the highest probability of approving an SBA loan will save countless headaches.

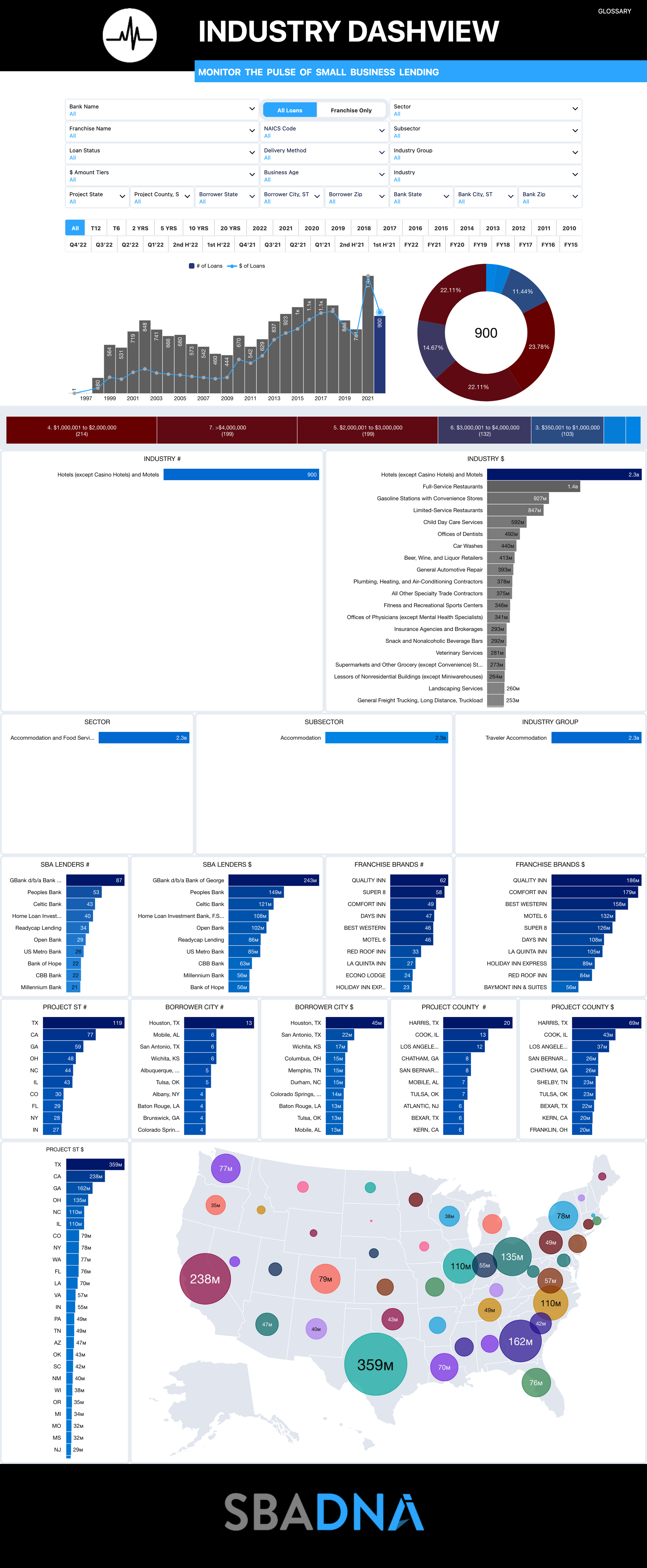

Below is the most recent lending data for the Hotels and Motels industry.

2021 Loans:

Lenders: 217

Approvals: 1,366

Amounts: $3.4B

Average: $2,461,021

2022 Loans:

Lenders: 173

Approvals: 900

Amounts: $2.3B

Average: $2,573,495

All-Time Loans:

Lenders: 1,106

Approvals: 18,636

Amounts: $29.8B

Average: $1,597,576

Hotels & Motels Industry Lending Data For All SBA 7(a) Loans:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

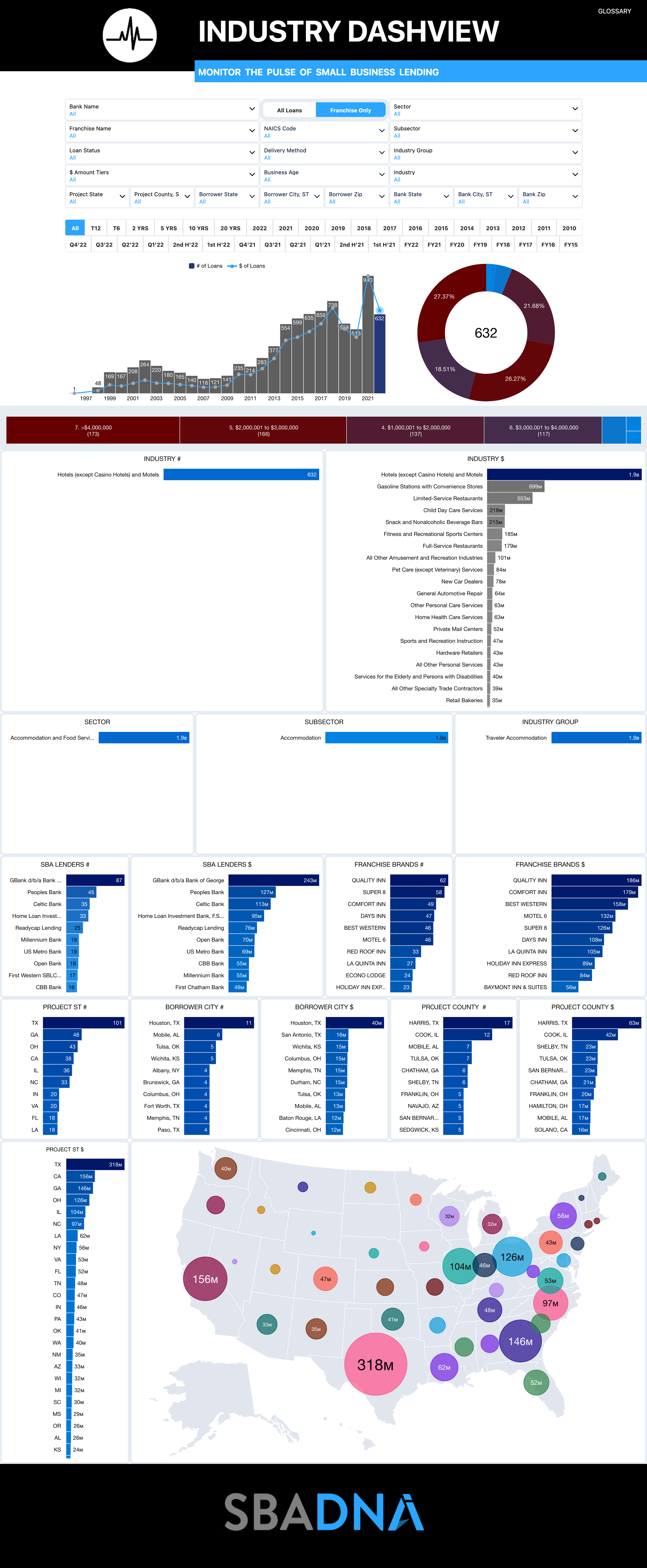

Hotels & Motels Industry Lending Data For Franchise SBA 7(a) Loans Only:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

60%

of all SBA Lenders of all time have never approved an SBA loan over $1 Million.

We can find the right one for you; for free. LEARN MORE.

Byline Bank Is A Top-Ranked Lender For Hotels & Motels

Ad*

Resources:

NAICS INDUSTRY

Our SBA 7a lending information is based on Hotels (excluding Casino Hotels) and Motels NACIS code 721110.

The NAICS website describes this industry as:

This industry comprises establishments primarily engaged in providing short-term lodging in facilities known as hotels, motor hotels, resort hotels, and motels. The establishments in this industry may offer food and beverage services, recreational services, conference rooms, convention services, laundry services, parking, and other services.